Superfluid Staking

Abstract

Superfluid Staking provides the consensus layer more security with a

sort of "Proof of Useful Stake". Each person gets an amount of Osmo

representative of the value of their share of liquidity pool tokens

staked and delegated to validators, resulting in the security guarantee

of the consensus layer to also be based on GAMM LP shares. The OSMO

token is minted and burned in the context of Superfluid Staking.

Throughout all of this, OSMO's supply is preserved in queries to the

bank module.

The process

All of the below methods are found under the Superfluid

modules.

- The

SuperfluidDelegate method stores your share of bonded

liquidity pool tokens, with validateLock as a verifier for lockup

time.

GetSuperfluidOsmo mints OSMO tokens each day for delegation as a

representative of the value of your pool share. This amount is

minted because the staking module at the moment requires staked

tokens to be in OSMO. This amount is burned each day and re-minted

to keep the representative amount of the value of your pool share

accurate. The lockup duration is guaranteed from the underlying

lockup module.GetExpectedDelegationAmount iterates over each (denom, delegate)

pair and checks for how much OSMO we have delegated. The difference

from the current balance to what is expected is burned / minted to

match with the expected.- A

messageServer method executes the Superfluid delegate message.

syntheticLockup is used to index bond holders and tracking their

addresses for reward distribution or potentially slashing purposes.

These track whether if your Superfluid stake is currently bonding or

unbonding.- An

IntermediaryAccount is mostly used for the actual reward

distribution or slashing events, and are responsible for

establishing the connection between each superfluid staked lock and

their delegation to the validator. These work by transferring the

superfluid OSMO to their respective delegators. Rewards are linearly

scaled based on how much you have locked for a given (validator,

denom) pair. Rewards are first moved to the incentive gauges, then

distributed from the gauges. In this way, we're using the existing

gauge reward system for paying out superfluid staking rewards and

tracking the amount you have superfluidly staked using the lockup

module.

- Rewards are distributed per epoch, which is currently a day.

abci.go checks whether or not the current block is at the

beginning of the epoch using BeginBlock.

- Superfluid staking will continue to expand to other Osmosis pools

based on governance proposals and vote turnouts.

Example

If Alice has 500 GAMM tokens bonded to the ATOM <> OSMO, she will have

the equivalent value of OSMO minted, delegated to her chosen staker, and

burned for her each day with Superfluid staking. On the user side, all

she has to know is who she wants to delegate her tokens to. In order to

switch delegation, she has to unbond her tokens from the pool first and

then redeposit. Bob, who has a share of the same liquidity pool before

Superfluid Staking went live, also has to re-deposit into the pool for

the above process to kickstart.

Why mint Osmo? How is this method safe and accurate?

Superfluid staking requires the minting of OSMO because in order to

stake on the Osmosis chain, OSMO tokens are required as the chosen

collateral. Synthetic Osmo is minted here as a representative of the

value of each superfluid staker's liquidity pool tokens.

The pool tokens are acquired by the user from normally staking in a

liquidity pool. They get minted an amount of OSMO equivalent to the

value of their GAMM pool tokens. This method is accurate because

querying the value OSMO every day allows for burning and minting

according to the difference in value of OSMO relative to the expected

delegation amount (as seen with

GetExpectedDelegationAmount).

It's like having a price oracle for fairly calculating the amount the

user has superfluidly staked.

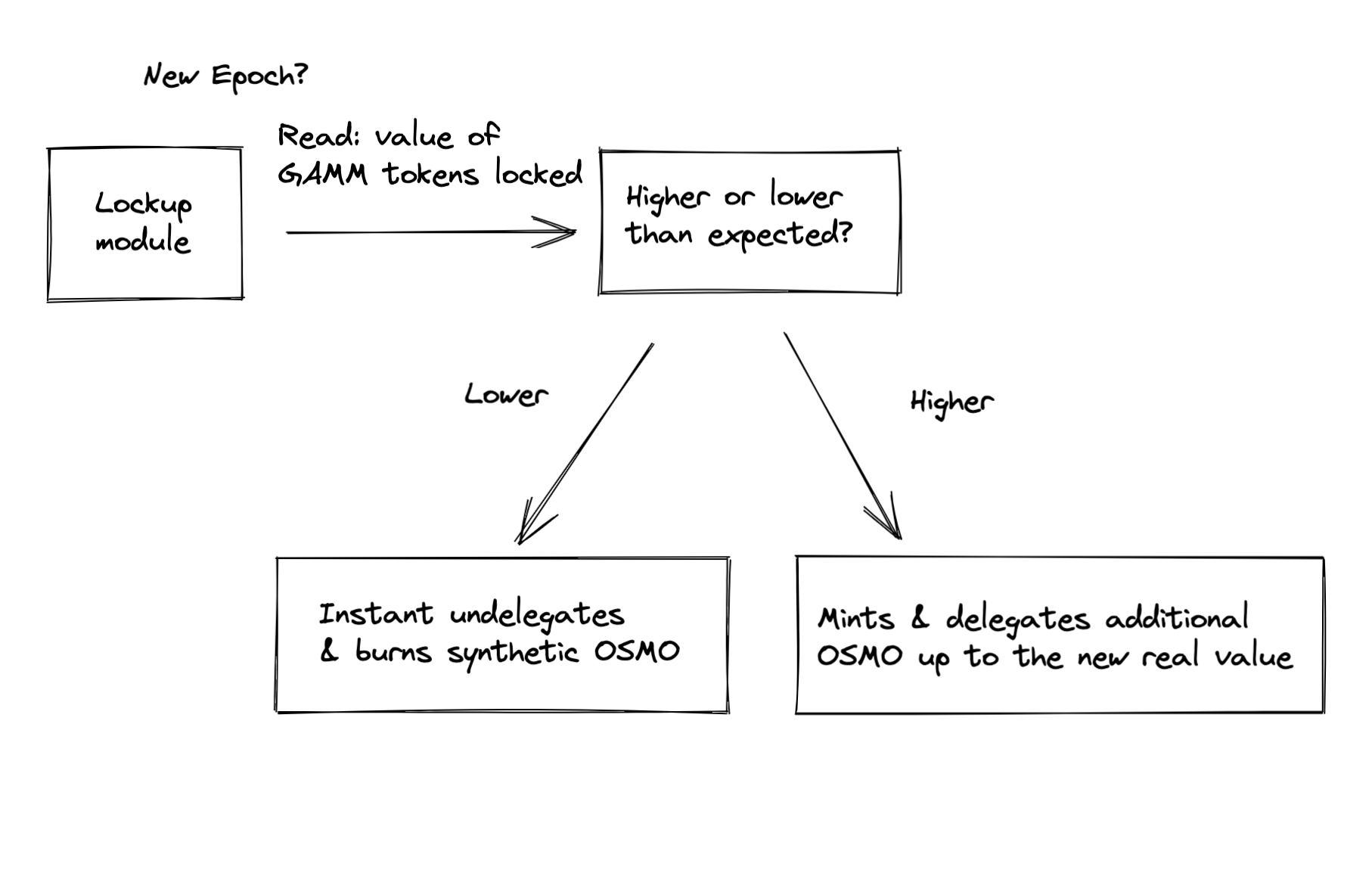

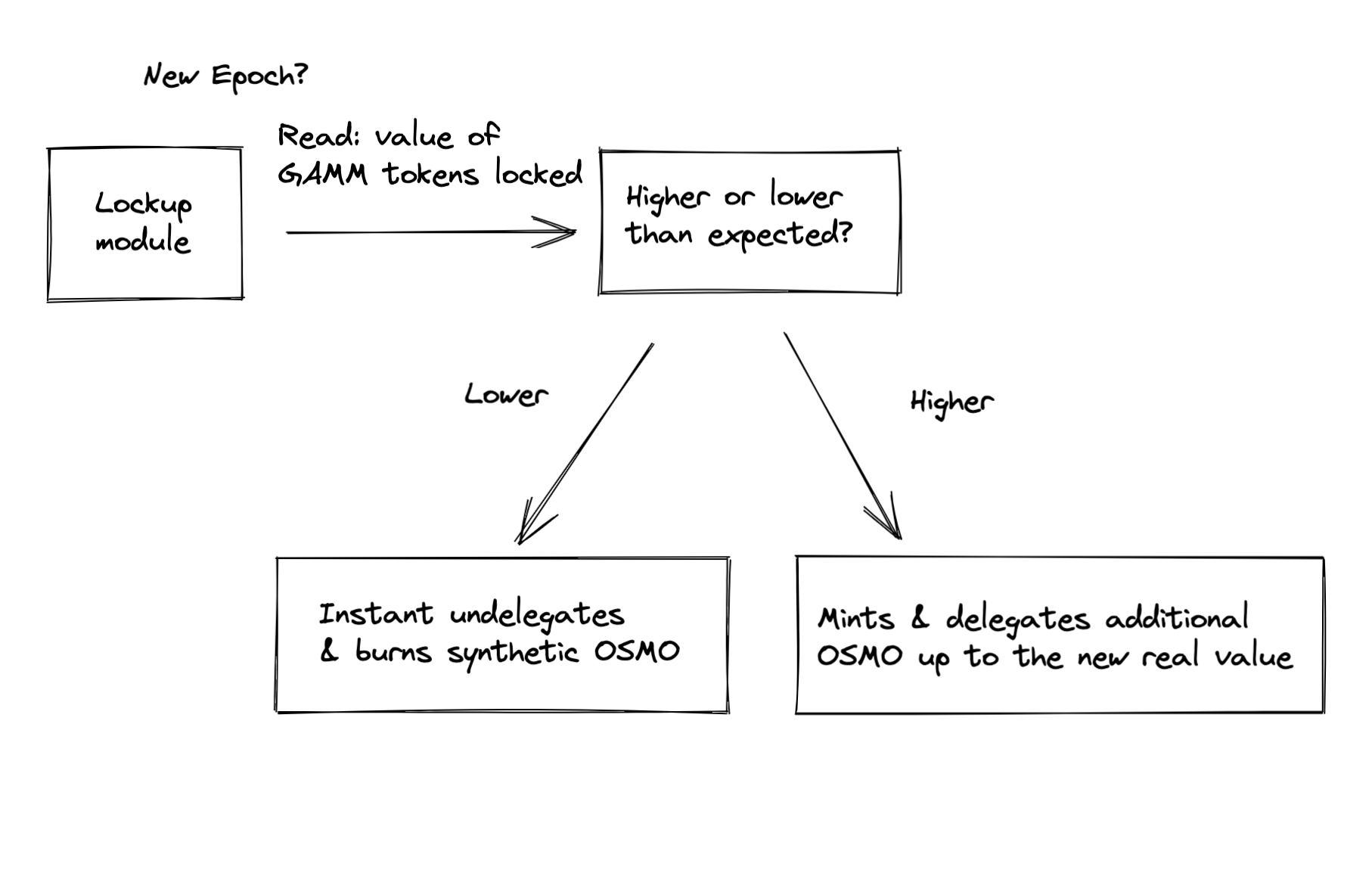

On epoch (start of every day), we read from the lockup module how much

GAMM tokens we have locked which acts as an oracle for the

representative price of the GAMM token shares. The superfluid module has

"hooks" messages to refresh delegation amounts

(RefreshIntermediaryDelegationAmounts) and to increase delegation on

lockup (IncreaseSuperfluidDelegation). Then, we see whether or not the

superfluid OSMO currently delegated is worth more or less than this

expected delegation amount amount. If the OSMO is worth more, we do

instant undelegations and immediately burn the OSMO. If less, we mint

OSMO and update the amount delegated. A simplified diagram of this whole

process is found below:

This minting is safe because we strict constrain the permissions of Bank

(the module that burns and mints OSMO) to do what it's designed to do.

The authority is mediated through mintOsmoTokensAndDelegate and

forceUndelegateAndBurnOsmoTokens keeper methods called by the

SuperfluidDelegate and SuperfluidUndelegate message handlers for the

tokens. The hooks above that increase delegation and refresh delegation

amounts also call this keeper method.

The delegation is then verified to not already be associated with an

intermediary account (to prevent double-staking), and is always

delegated or withdrawn taking into account various multipliers for

synthetic OSMO value (its worth with respect to the liquidity pool, and

a risk modifier) to prevent mint inaccuracies. Before minting, we also

check that the message sender is the owner of the locked funds; that the

lock is not unlocking; is locked for at least the unbonding period, and

is bonded to a single asset. We also check to see if the lock isn't

already in superfluid and that the same lock isn't currently being

unbonded.

On the end of each epoch, we iterate through all intermediary accounts

to withdraw delegation rewards they may have received and put it all

into the perpetual gauges corresponding to each account for reward

delegation.

Bonding, unbonding, slashing

Here, we describe how token bonding and unbonding works, and what

happens to your superfluid tokens in the case of a slashing event.

Bonding

When bonding, your input tokens are locked up and you are given GAMM

pool tokens in exchange. These GAMM pool tokens represent a share of the

total liquidity pool, and allows you to get transaction fees or

participate in external incentive gauge token distributions. When

bonding, on top of the regular bonding transaction there will also be a

selection of validators. As stated above, OSMO is also minted and burned

each day and superfluidly staked to whoever you have chosen to be your

validator. You gain additional APR as a reward for bolstering the

Osmosis chain's consensus integrity by delegating.

Unbonding

When unbonding, superfluid tokens get un-delegated. After making sure

that the unbond message sender is the owner of their corresponding

locked funds, the existing synthetic lockup is deleted and replaced with

a new synthetic lockup for unbonding purposes. The undelegated OSMO is

then instantly withdrawn from the intermediate account and validator

using the InstantUndelegate function. The OSMO that was originally used

for representing your LP shares are burnt. Moves the tracker for

unbonding, allows the underlying lock to start unlocking if desired

Concepts

SyntheticLockups

SyntheticLockups are synthetica of PeriodLocks, but different in the

sense that they store suffix, which is a combination of

bonding/unbonding status + validator address. This is mainly used to

track whether an individual lock that has been superfluid staked has an

bonding status or a unbonding status from the staking delegations.

Intermediary Accounts establishes the connections between the superfluid

staked locks and delegations to the validator. Intermediary accounts

exists for every denom + validator combination, so that it would group

locks with the same denom + validator selection. Superfluid staking a

lock would mint equivalent amount of OSMO of the lock and send it to the

intermediary account and the intermediarry accounts would be delegating

to the specified validator.

Intermediary Accounts Connection serves the role of tracking the locks

that an Intermediary Account is dedicated to.

State

Superfluid Asset

A superfluid asset is a alternative asset (non-OSMO) that is allowed by

governance to be used for staking.

It can only be updated by governance proposals. We validate at proposal

creation time that the denom + pool exists. (Are we going to ignore edge

cases around a reference pool getting deleted it)

Lots of questions to be answered here

Dedicated Gauges

Each intermediary account has has dedicated gauge where it sends the

delegation rewards to. Gauges are distributing the rewards to end users

at the end of the epoch.

Synthetic Lockups created

At the moment, one lock can only be fully bonded to one validator.

Osmo Equivalent Multipliers

The Osmo Equivalent Multiplier for an asset is the multiplier it has for

its value relative to OSMO.

Different types of assets can have different functions for calculating

their multiplier. We currently support two asset types.

- Native Token

The multiplier for OSMO is always 1.

- Gamm LP Shares

Currently we use the spot price for an asset based on a designated

osmo-basepair pool of an asset. The multiplier is set once per epoch, at

the beginning of the epoch. In the future, we will switch this out to

use a TWAP instead.

Messages

Superfluid Delegate

Owners of superfluid asset locks can submit MsgSuperfluidDelegate

transactions to delegate the Osmo in their locks to a selected

validator.

type MsgSuperfluidDelegate struct {

Sender string

LockId uint64

ValAddr string

}

State Modifications:

- Safety Checks that are being done before running superfluid logic:

- Check that

Sender is the owner of lock

- Check that

lock corresponds to a single locked asset

- Check that

lock is not unlocking

- Check that

lock is locked for at least the unbonding period

- Check that this

LockID is not already superfluided

- Check that the same lock isn't being unbonded

- Get the

IntermediaryAccount for this lock's Denom and ValAddr

pair.

- Create it + a new gauge for the synthetic denom, if it does not

yet exist.

- Create a SyntheticLockup.

- Calculate

Osmo to delegate on behalf of this lock, as

Osmo Equivalent Multiplier * # LP Shares *

Risk Adjustment Factor

- If this amount is less than 0.000001

Osmo (1 uosmo) reject

the transaction, as it would be delegating 0 uosmo

- Mint

Osmo to match this amount and send to IntermediaryAccount

- Create a delegation from

IntermediaryAccount to Validator

- Create a new perpetual

Gauge for distributing staking payouts to

locks of a synethic asset based on this Validator / Denom pair.

- Create a connection between this

lockID and this

IntermediaryAccount

Superfluid Undelegate

type MsgSuperfluidUndelegate struct {

Sender string

LockId uint64

}

State Modifications:

- Lookup

lock by LockID

- Check that

Sender is the owner of lock

- Get the

IntermediaryAccount for this lockID

- Delete the

SyntheticLockup associated to this lockID + ValAddr

pair

- Create a new

SyntheticLockup which is unbonding

- Calculate the amount of

Osmo delegated on behalf of this lock as

Osmo Equivalent Multiplier * # LP Shares *

Risk Adjustment Factor

- If this amount is less than 0.000001

Osmo, there is no

delegated Osmo to undelegate and burn

- Use

InstantUndelegate to instantly remove delegation from

IntermediaryAccount to Validator

- Immediately burn undelegated

Osmo

- Delete the connection between

lockID and IntermediaryAccount

Lock and Superfluid Delegate

type MsgLockAndSuperfluidDelegate struct {

Sender string

Coins sdk.Coins

ValAddr string

}

This is effectively a multimsg tx of lockup's MsgLockTokens and

superfluid's MsgSuperfluidDelegate, but it is implemented as a single

msg, because currently we don't have a way of passing the lockid

outputted by MsgLockTokens as an input into the

MsgSuperfluidDelegate prior to execution.

State Modifications:

- Ensures that Coins has a length of only 1 (we use sdk.Coins instead

of sdk.Coin in order to allow more flexibility in the future)

- Creates a lockup with Coins of a lock duration equivalent to the

unstaking period from the staking module

- Uses the lockup module's MsgServer

- Gets the lock id of the created lock, and uses it generate and

execute a MsgSuperfluidDelegate message

- Uses the SuperfluidDelegate function on this msg server

Superfluid Unbond Lock

type MsgSuperfluidUnbondLock struct {

Sender string

LockId uint64

}

This message does all the functionality of MsgSuperfluidUndelegate but

also starts unbonding the underlying lock as well, allowing both the

unstaking and unlocking to complete at the same time. Without using this

function, a user will not be able to start unbonding their underlying

lock until after the the unstaking has finished.

State Modifications:

- This runs the functionality of

MsgSuperfluidUndelegate

- It then triggers a force unbond of the underlying lock id

Create Full Range Position and Superfluid Delegate

type MsgCreateFullRangePositionAndSuperfluidDelegate struct {

Sender string

Coins sdk.Coins

ValAddr string

PoolId uint64

}

This is effectively a multi msg tx of concentrated liquidity's CreateFullRangePositionLocked, lockup's MsgLockTokens, and

superfluid's MsgSuperfluidDelegate, but it is implemented as a single

msg. Upon completion, the following response is given:

type MsgCreateFullRangePositionAndSuperfluidDelegateResponse struct {

LockID uint64

PositionID uint64

}

The message starts by creating a full range position in the given pool.

It then mints concentrated liquidity shares and locks them up for the

staking duration. From there, the normal superfluid delegation logic

is executed.

Add To Superfluid Concentrated Position

This message allows a user to add liquidity to a concentrated liquidity superfluid position.

type MsgAddToConcentratedLiquiditySuperfluidPosition struct {

PositionId uint64

Sender string

TokenDesired0 types.Coin

TokenDesired1 types.Coin

}

It does so by performing the following steps:

- perform validation of the input parameters

- make sure that position is locked

- belongs to the sender

- lock duration is correct and belongs to the sender

- superfluid undelegate without synthetic lock creation

- withdraw old position

- make sure position isn't the last one in pool. Fail if so

- update tokens for a new position (added + withdrawn)

- created locked SF position

- SF delegate (also creates synth lock)

Upon successful execution, the following response is given:

type MsgAddToConcentratedLiquiditySuperfluidPositionResponse struct {

PositionId uint64

Amount0 github_com_cosmos_cosmos_sdk_types.Int

Amount1 github_com_cosmos_cosmos_sdk_types.Int

NewLiquidity github_com_cosmos_cosmos_sdk_types.Dec

LockId uint64

}

Epochs

Overall Epoch sequence

- Epoch N ends, during AfterEpochEnd:

- Distribute gauge rewards for all non-superfluid gauges

- Mint new tokens

- Issue new Osmo, and send to various modules (distribution,

incentives, etc.)

- 25% currently goes to

x/distribution which funds Staking

and Superfluid rewards

- Rewards for

Superfluid are based on the just updated

delegation amounts, and queued for payout in the next epoch

- BeginBlock for Distribution

- Distribute staking rewards to all of the 'lazy accounting'

accumulators. (F1)

- Epoch N ends, during BeginBlock for superfluid After

AfterEpochEnd:

- Claim staking rewards for every

Intermediary Account, put them

into gauges.

- Distribute Superfluid staking rewards from gauges to bonded

Synthetic Lock owners

- Update

Osmo Equivalent Multiplier value for each LP token

- (Currently spot price at epoch)

- Refresh delegation amounts for all

Intermediary Accounts

- Calculate the expected delegation for this account as

Osmo Equivalent Multiplier # LP Shares

Risk adjustment

- If this is less than 0.000001

Osmo it will be rounded

to 0

- Lookup current delegation amount for

Intermediary Account

- If there is no delegation, treat the current delegation

as 0

- If expected amount > current delegation:

- Mint new

Osmo and Delegate to Validator

- If expected amount < current delegation:

- Use

InstantUndelegate and burn the received Osmo

Staking power updates

We need to be concerned with how/when validators enter and leave the

active set.

We expect the guarantee that there is an Intermediary account for every

(active validator, superfluid denom) pair, and every (unbonding

validator, superfluid denom) pair. (TODO: Where/why)

We also want to avoid resource exhaustion attacks. We relegate concerns

around upper-bounding the number of active + unbonding validators to the

staking module. This module is liable to potentially cause a 100-1000x

amplification factor on this workload.

How we handle it now

- Intermediary accounts are not created on SetSuperfluidAsset

- They are created at-time-of-need on MsgSuperfluidDelegate

- Concerns: What happens if you delegate to an unbonding or jailed

validator. Note: Isn't it same as normal delegation for unbonding

validator?

Other Module Hooks

-----;

In this section we describe the "hooks" that superfluid module

receives from other modules.

AfterEpochEnd

On AfterEpochEnd, we iterate through all existing intermediary accounts

and withdraw delegation rewards they have received. Then we send the

collective rewards to the perpetual gauge corresponding to the

intermediary account. Then we update OSMO backing per share for the

specific pool. After the update, iteration through all intermediate

accounts happen, undelegating and bonding existing delegations for all

superfluid staking and use the updated spot price at epoch time to mint

and delegate.

AfterAddTokensToLock

When a token is locked, we first check if the corresponding lock is

currently in the state of superfluid delegation. If it is, we run the

logic to add delegation via intermediary account.

BeforeValidatorSlashed

Slashes the synthetic lockups and native lockups that is connected to

the to be slashed validator.

Proposal Hooks

-----;

In this section we describe the proposals that is associated to

superfluid module.

SetSuperfluidAssetsProposal

Enable multiple superfluid assets to be used for superfluid staking.

RemoveSuperfluidAssetsProposal

Disable multiple assets from being used for superfluid staking.

Events

There are 7 types of events that exist in Superfluid module:

types.TypeEvtSetSuperfluidAsset - "set_superfluid_asset"types.TypeEvtRemoveSuperfluidAsset - "remove_superfluid_asset"types.TypeEvtSuperfluidDelegate - "superfluid_delegate"types.TypeEvtSuperfluidIncreaseDelegation - "superfluid_increase_delegation"types.TypeEvtSuperfluidUndelegate - "superfluid_undelegate"types.TypeEvtSuperfluidUnbondLock - "superfluid_unbond_lock"types.TypeEvtUnpoolId - "unpool_pool_id"

types.TypeEvtSetSuperfluidAsset

This event is emitted in the proposal which set new superfluid asset

It consists of the following attributes:

types.AttributeDenom

- The value is the asset denom.

types.AttributeSuperfluidAssetType

- The value is the type of asset.

types.TypeEvtRemoveSuperfluidAsset

This event is emitted in the proposal which removes the superfluid asset

It consists of the following attributes:

types.AttributeDenom

- The value is the asset denom.

types.TypeEvtSuperfluidDelegate

This event is emitted in the message server after successfully creating a delegation for the given lock ID and the validator to delegate to.

It consists of the following attributes:

types.AttributeLockId

- The value is the given lock ID.

types.AttributeValidator

- The value is the validator address to delegate to.

types.TypeEvtSuperfluidIncreaseDelegation

This event is emitted in the hook after adding more token to the existing lock

It consists of the following attributes:

types.AttributeLockId

- The value is the given lock ID.

types.AttributeAmount

- The value is the token amount added to the lock.

types.TypeEvtSuperfluidUndelegate

This event is emitted in the message server after undelegating the currently superfluid delegated position given by lock ID.

It consists of the following attributes:

types.AttributeLockId

- The value is the given lock ID.

types.TypeEvtSuperfluidUnbondLock

This event is emitted in the message server after starting unbonding for the currently superfluid undelegating lock.

It consists of the following attributes:

types.AttributeLockId

- The value is the given lock ID.

types.TypeEvtUnpoolId

This event is emitted in the message server UnPoolWhitelistedPool

It consists of the following attributes:

types.AttributeKeySender

- The value is the msg sender address.

types.AttributeLockId

- The value is the pool lpShareDenom.

types.AttributeNewLockIds

- The value is the exited lock ids in byte[].

Messages

MsgSuperfluidDelegate

| Type |

Attribute Key |

Attribute Value |

| superfluid_delegate |

lock_id |

{lock_id} |

| superfluid_delegate |

validator |

{validator} |

MsgSuperfluidUndelegate

| Type |

Attribute Key |

Attribute Value |

| superfluid_undelegate |

lock_id |

{lock_id} |

MsgSuperfluidUnbondLock

| Type |

Attribute Key |

Attribute Value |

| superfluid_unbond_lock |

lock_id |

{lock_id} |

MsgLockAndSuperfluidDelegate

| Type |

Attribute Key |

Attribute Value |

| lock_tokens |

period_lock_id |

{periodLockID} |

| lock_tokens |

owner |

{owner} |

| lock_tokens |

amount |

{amount} |

| lock_tokens |

duration |

{duration} |

| lock_tokens |

unlock_time |

{unlockTime} |

| message |

action |

lock_tokens |

| message |

sender |

{owner} |

| transfer |

recipient |

{moduleAccount} |

| transfer |

sender |

{owner} |

| transfer |

amount |

{amount} |

| superfluid_delegate |

lock_id |

{lock_id} |

| superfluid_delegate |

validator |

{validator} |

Proposals

SetSuperfluidAssetsProposal

| Type |

Attribute Key |

Attribute Value |

| set_superfluid_asset |

denom |

{denom} |

| set_superfluid_asset |

superfluid_asset_type |

{asset_type} |

RemoveSuperfluidAssetsProposal

| Type |

Attribute Key |

Attribute Value |

| remove_superfluid_asset |

denom |

{denom} |

Queries

Params

message ParamsRequest {};

message ParamsResponse {

// params defines the parameters of the module.

Params params = 1 [ (gogoproto.nullable) = false ];

}

message Params {

osmomath.Dec minimum_risk_factor = 1; // serialized as string

}

The params query returns the params for the superfluid module. This

currently contains:

MinimumRiskFactor which is an osmomath.Dec that represents the discount

to apply to all superfluid staked modules when calculating their

staking power. For example, if a specific denom has an OSMO

equivalent value of 100 OSMO, but the the MinimumRiskFactor param

is 0.05, then the denom will only get 95 OSMO worth of staking power

when staked.

AssetType

message AssetTypeRequest {

string denom = 1;

};

message AssetTypeResponse {

SuperfluidAssetType asset_type = 1;

};

enum SuperfluidAssetType {

SuperfluidAssetTypeNative = 0;

SuperfluidAssetTypeLPShare = 1;

}

The AssetType query returns what type of superfluid asset a denom is.

AssetTypes are meant for when we support more types of assets for

superfluid staking than just LP shares. Each AssetType has a different

algorithm used to get its "Osmo equivalent value".

We represent different types of superfluid assets as different enums.

Currently, only enum 1 is actually used. Enum value 0 is reserved

for the Native staking token for if we deprecate the legacy staking

workflow to have native staking also go through the superfluid module.

In the future, more enums will be added.

If this query errors, that means that a denom is not allowed to be used

for superfluid staking.

AllAssets

message AllAssetsRequest {};

message AllAssetsResponse {

repeated SuperfluidAsset assets = 1 [ (gogoproto.nullable) = false ];

};

message SuperfluidAsset {

string denom = 1;

SuperfluidAssetType asset_type = 2;

}

This parameterless query returns a list of all the superfluid staking

compatible assets. The return value includes a list of SuperfluidAssets,

which are pairs of denom with SuperfluidAssetType which was

described in the previous section.

This query does not currently support pagination, but may in the future.

AssetMultiplier

message AssetMultiplierRequest {

string denom = 1;

};

message AssetMultiplierResponse {

OsmoEquivalentMultiplierRecord osmo_equivalent_multiplier = 1;

};

message OsmoEquivalentMultiplierRecord {

int64 epoch_number = 1;

string denom = 2;

string multiplier = 3;

}

This query allows you to find the multiplier factor on a specific denom.

The Osmo-Equivalent-Multiplier Record for epoch N refers to the osmo

worth we treat a denom as having, for all of epoch N. For now, this is

the spot price at the last epoch boundary, and this is reset every

epoch. We currently don't store historical multipliers, so the epoch

parameter is kind of meaningless for now.

To calculate the staking power of the denom, one needs to multiply the

amount of the denom with OsmoEquivalentMultipler from this query with

the MinimumRiskFactor from the Params query endpoint.

staking_power = amount * OsmoEquivalentMultipler * MinimumRiskFactor

message ConnectedIntermediaryAccountRequest {

uint64 lock_id = 1;

}

message ConnectedIntermediaryAccountResponse {

SuperfluidIntermediaryAccountInfo account = 1;

}

message SuperfluidIntermediaryAccount {

string denom = 1;

string val_addr = 2;

uint64 gauge_id = 3; // perpetual gauge for rewards distribution

}

Every superfluid denom and validator pair has an associated

"intermediary account", which does the actual delegation. This query

helps find the superfluid intermediary account for any superfluid

position.

That lock_id parameter passed in is the underlying lock id for the

superfluid, NOT the synthetic lock id.

This query can be used to find the validator a superfluid lock is

delegated to. The gauge_id also refers to the perpetual gauge that is

used to pay out the superfluid positions associated with this

intermediary account.

message AllIntermediaryAccountsRequest {

cosmos.base.query.v1beta1.PageRequest pagination = 1;

};

message AllIntermediaryAccountsResponse {

repeated SuperfluidIntermediaryAccountInfo accounts = 1;

cosmos.base.query.v1beta1.PageResponse pagination = 2;

};

This query returns a list of all superfluid intermediary accounts. It

supports pagination.

SuperfluidDelegationAmount

message SuperfluidDelegationAmountRequest {

string delegator_address = 1;

string validator_address = 2;

string denom = 3;

}

message SuperfluidDelegationAmountResponse {

repeated cosmos.base.v1beta1.Coin amount = 1 [];

}

This query returns the amount of underlying denom (i.e. lp share) for a

triplet of delegator, validator, and denom.

SuperfluidDelegationsByDelegator

message SuperfluidDelegationsByDelegatorRequest {

string delegator_address = 1;

}

message SuperfluidDelegationsByDelegatorResponse {

repeated SuperfluidDelegationRecord superfluid_delegation_records = 1;

repeated cosmos.base.v1beta1.Coin total_delegated_coins = 2;

}

message SuperfluidDelegationRecord {

string delegator_address = 1;

string validator_address = 2;

cosmos.base.v1beta1.Coin delegation_amount = 3;

}

This query returns a list of all the superfluid delegations of a

specific delegator. The return value includes, the validator delegated to

and the delegated coins (both denom and amount).

The return value of the query also includes the total_delegated_coins

which is the sum of all the delegations of that validator.

This query does require iteration that is linear with the number of

delegations a delegator has made, but for now until we support many

superfluid denoms, should be relatively bounded. Once that increases, we

will need to support pagination.

SuperfluidDelegationsByValidatorDenom

message SuperfluidDelegationsByValidatorDenomRequest {

string validator_address = 1;

string denom = 2;

}

message SuperfluidDelegationsByValidatorDenomResponse {

repeated SuperfluidDelegationRecord superfluid_delegation_records = 1;

}

This query returns a list of all superfluid delegations that are with a

validator / superfluid denom pair. This query requires a lot of

iteration and should be used sparingly. We will need to add pagination

to make this usable.

EstimateSuperfluidDelegatedAmountByValidatorDenom

message EstimateSuperfluidDelegatedAmountByValidatorDenomRequest {

string validator_address = 1;

string denom = 2;

}

message EstimateSuperfluidDelegatedAmountByValidatorDenomResponse {

repeated cosmos.base.v1beta1.Coin total_delegated_coins = 1;

}

This query returns the total amount of delegated coins for a validator /

superfluid denom pair. This query does NOT involve iteration, so should

be used instead of the above SuperfluidDelegationsByValidatorDenom

whenever possible. It is called an "Estimate" because it can have some

slight rounding errors, due to conversions between osmomath.Dec and

osmomath.Int", but for the most part it should be very close to the sum of

the results of the previous query.

Parameters

The superfluid module contains the following parameters:

| Key |

Type |

Example |

| minimum_risk_factor |

decimal |

0.01 |

Slashing

Slashing works by gathering all accounts who were superfluidly staking

and delegated to the violating validator and slashing their underlying

lock collateral. The amount of tokens to slash are first calculated then

removed from the underlying and synthetic lock. Therefore, it is

important to select a reputable or reliable validator as to minimize

slashing risks on your tokens. At the moment we are slashing at latest

price rather than block height price. All slashed tokens go to the

community pool.

We first get a hook from the staking module, marking that a validator is

about to be slashed at a slashFactor of f, for an infraction at height

h.

The staking module handles slashing every delegation to that validator,

which will handle slashing the delegation from every intermediary

account. However, it is up to the superfluid module to then:

- Slash every constituent superfluid staking position for this

validator.

- Slash every unbonding superfluid staking position to this validator.

We do this by:

- Collect all intermediate accounts to this validator

- For each IA, iterate over every lock to the underlying native denom.

- If the lock has a synthetic lockup, it gets slashed.

- The slash works by calculating the amount of tokens to slash.

- It removes these from the underlying lock and the synthetic lock.

- These coins are moved to the community pool.

Slashing a concentrated liquidity superfluid lockup happens in the same way, however

instead of sending the concentrated full range position shares from the lockup

module account to the community pool, we determine the underlying assets

that the slashed shares represent and send those from the respective pool

account to the community pool. The shares residing in the lockup module

account that represented the funds that got sent to the community pool are then burned.

Nuances

- Slashed tokens go to the community pool, rather than being burned as

in staking.

- We slash every unbonding, rather than just unbondings that started

after the infraction height.

- We can "overslash" relative to the staking module. (For a slash

factor of 5%, the staking module can often burn <5% of active

delegation, but superfluid will always slash 5%)

We slash every unbonding, purely because lockup module tracks things by

unbonding start time, whereas staking/slashing tracks things by height

we begin unbonding at. Thus we get a problem that we cannot convert

between these cleanly. Really there should be a storage of all

historical block height <> block times for everything in the unbonding

period, but this is not considered a near-term problem.

Correcting overslashing

The overslashing possibility stems from a problem in the SDKs slashing

module, that really is a bug there, and superfluid is doing the correct

thing. https://github.com/cosmos/cosmos-sdk/issues/1440

Basically, slashes to unbondings and redelegations can lower the amount

that gets slashed from live delegations in the staking module today.

It turns out this edge case, where superfluid's intermediate account can

have more delegation than expected from its underlying collateral, is

already safely handled by the Superfluid refreshing logic.

The refreshing logic checks the total amount of tokens in locks to this

denom (Reading from the lockup accumulation store), calculates how many

osmo that's worth at the epochs new osmo worth for that asset, and then

uses that. Thus this safely handles this edge case, as it uses the new

'live' lockup amount.

Minting

Superfluid module has the ability to arbitrarily mint and burn Osmo

through the bank module. This is potentially dangerous so we strictly

constrain it's ability to do so. This authority is mediated through the

mintOsmoTokensAndDelegate and forceUndelegateAndBurnOsmoTokens

keeper methods, which are in turn called by message handlers

(SuperfluidDelegate and SuperfluidUndelegate) as well as by hooks on

Epoch (RefreshIntermediaryDelegationAmounts) and Lockup

(IncreaseSuperfluidDelegation)

Invariant

Each of these mechanisms maintains a local invariant between the amount

of Osmo minted and delegated by the IntermediaryAccount, and the

quantity of the underlying asset held by locks associated to the

account, modified by OsmoEquivalentMultiplier and RiskAdjustment for

the underlying asset. Namely that total minted/delegated =

GetTotalSyntheticAssetsLocked * GetOsmoEquivalentMultiplier *

GetRiskAdjustment

This can be equivalently expressed as GetExpectedDelegationAmount

being equal to the actual delegation amount.

Message Handlers

SuperfluidDelegate

In a SuperfluidDelegate transaction, we first verify that this lock is

not already associated to an IntermediaryAccount, and then use

mintOsmoTokenAndDelegate to properly balance the resulting change in

GetExpectedDelegationAmount from the increase in

GetTotalSyntheticAssetsLocked. i.e. we mint and delegate:

GetOsmoEquivalentMultiplier * GetRiskAdjustment *

lock.Coins.Amount new Osmo tokens.

SuperfluidUndelegate

When a user submits a transaction to unlock their asset the invariant is

maintained by using forceUndelegateAndBurnOsmoTokens to remove an

amount of Osmo equal to lockedCoin.Amount *

GetOsmoEquivalentMultiplier * GetRiskAdjustment.

Superfluid Hooks

In the RefreshIntermediaryDelegationAmounts method, calls are made to

mintOsmoTokensAndDelegate or forceUndelegateAndBurnOsmoTokens to

adjust the real delegation up or down to match

GetExpectedDelegationAmount.

IncreaseSuperfluidDelegation (AfterAddTokensToLock Hook)

This is called as a result of a user adding more assets to a lock that

has already been associated to an IntermediaryAccount. The invariant

is maintained by using mintOsmoTokenAndDelegate to match the amount of

new asset locked * GetOsmoEquivalentMultiplier * GetRiskAdjustment

for the underlying asset.

SlashLockupsForValidatorSlash (BeforeValidatorSlashed Hook)

During slashing the invariant is likely to be temporarily broken if the

referenced validator has any unbonding delegations. These unbonding

delegations are slashed first, which means that the amount delegated by

the IntermediaryAccount will be slashed by less than the

SyntheticLocks held by the account.

See Also

GetTotalSyntheticAssetsLocked

TODO - expand on this Uses lockup accumulator to find total amount of

synthetic locks for a given IntermediaryAccount (Superfluid Asset +

Validator pair)

Documentation

¶

Documentation

¶